Oxford Lane Capital (OXLC)·Q3 2026 Earnings Summary

Oxford Lane Capital Slashes Dividend 50% as NAV Plunges 19%

January 30, 2026 · by Fintool AI Agent

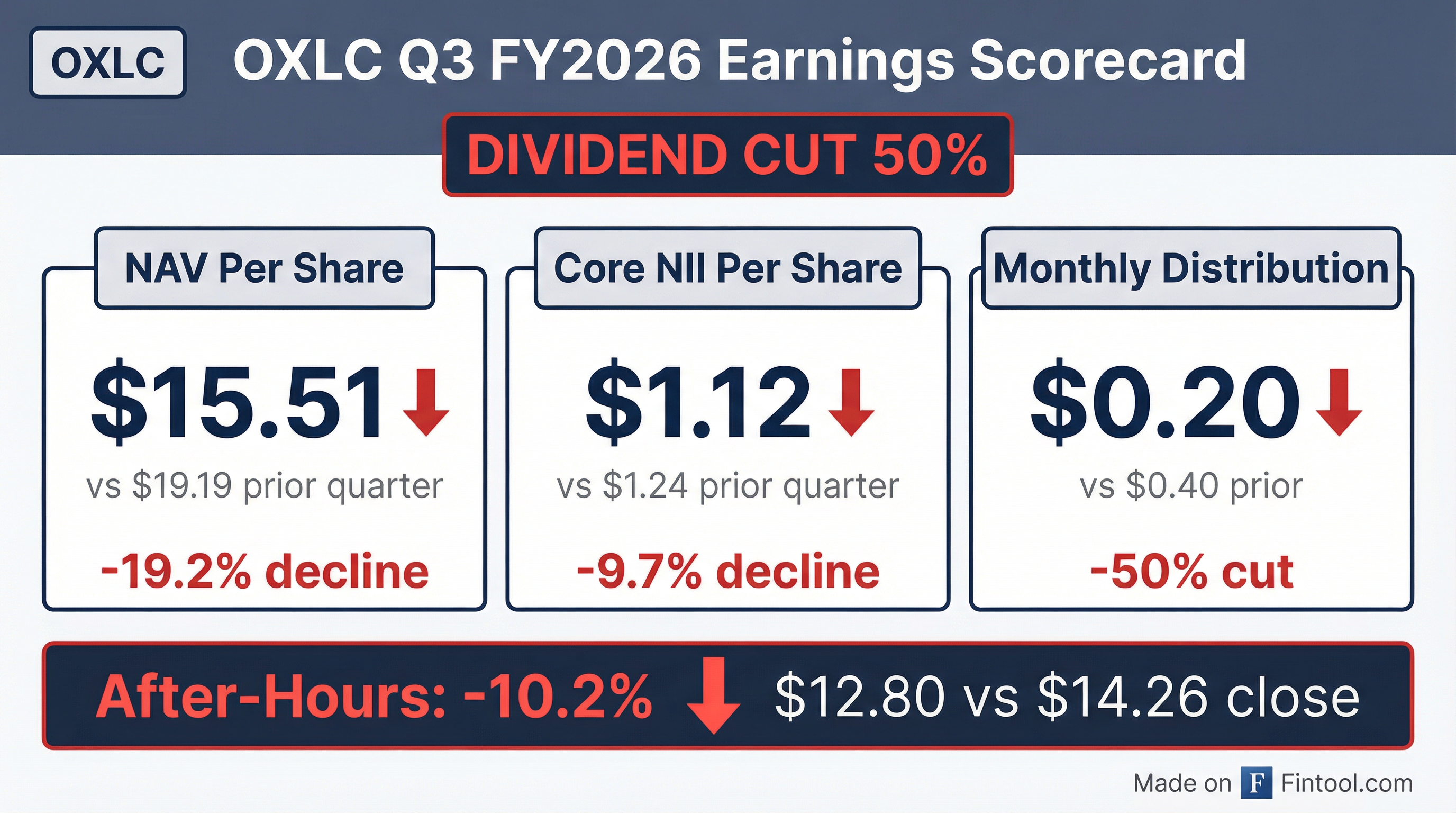

Oxford Lane Capital (OXLC) reported Q3 FY2026 results that shocked income-focused investors. The CLO-focused closed-end fund slashed its monthly distribution by 50% to $0.20 per share while NAV per share cratered 19.2% to $15.51. The stock immediately fell 10.2% in after-hours trading to $12.80.

Did Oxford Lane Cut Its Dividend?

Yes — a significant 50% reduction. The Board declared monthly distributions of $0.20 per share for April-June 2026, down from the prior $0.40 rate.

Management's rationale: The Board concluded it would be "beneficial for the Company and its shareholders to have additional capital to deploy" in CLO markets, and believes "a stable or growing NAV is a meaningful component of the return it seeks to generate."

Translation: The fund is retaining more cash to shore up NAV rather than paying it out to shareholders.

What Happened to NAV?

NAV per share collapsed from $19.19 to $15.51 — a 19.2% decline in a single quarter.

The NAV destruction was driven by massive unrealized losses:

- Net unrealized depreciation: $305.4 million ($3.14 per share)

- Net realized losses: $7.0 million ($0.07 per share)

- Total decrease in net assets from operations: $240.7 million ($2.47 per share)

The total fair value of investments fell to $2.26 billion from $2.60 billion the prior quarter.

How Is Core NII Trending?

Core NII — management's preferred measure of cash-generating ability — declined to $1.12 per share, down 9.7% sequentially.

Key concern: Distributions of $1.20/share exceeded Core NII of $1.12/share this quarter, meaning the fund paid out more than it earned on a cash basis. The dividend cut addresses this coverage gap.

At the new $0.60/quarter rate, distributions would be covered by Core NII with ~$0.52/share cushion.

What's Happening to CLO Yields?

Portfolio yields are compressing across the board:

The decline in CLO equity effective yields reflects pressure on the underlying loan portfolios. The collateral weighted average price in the CLO portfolios fell to 96.40% from 96.72%.

Portfolio Activity

Investment activity slowed significantly this quarter:

The portfolio consists of 294 investments, with 99% in CLO equity and 1% in CLO debt.

How Did the Stock React?

OXLC closed at $14.26 on January 29, 2026, then dropped 10.2% in after-hours trading to $12.80 following the earnings release. This brings the stock close to its 52-week low of $12.88.

The after-hours price of $12.80 represents:

- 17.5% discount to NAV ($15.51)

- 20% yield at new $0.20/month distribution rate

- 50.7% decline from 52-week high

What Changed From Last Quarter?

The quarter marked a significant deterioration across nearly every metric, with the Board taking decisive action to preserve capital through the dividend cut.

Capital Structure

OXLC maintains $719 million in preferred stock and debt outstanding against $1.51 billion in equity:

Leverage ratios remain manageable:

- Preferred Stock & Debt-to-Equity: 0.48x

- Debt-to-Equity: 0.33x

Industry Exposure

The CLO portfolio provides diversified exposure across 30 industries:

What's Happening in CLO Markets?

Managing Director Joe Kupka provided context on the broader CLO environment:

The decline in US loan prices led to an approximate 2-point decrease in median CLO equity NAVs. While the 12-month default rate improved, management noted that "out-of-court restructurings, exchanges, and subpar buybacks, which are not captured in the cited default rate, remain elevated."

Oxford Lane extended its weighted average reinvestment period from May 2029 to August 2029 by leading or participating in more than 10 resets and refinancings during the quarter.

Q&A Highlights: What Analysts Asked

Captive CLO Funds Compressing Returns

Analyst Mickey Schleien (Ladenburg Thalmann) raised a key structural concern about captive CLO funds — funds tied to large credit investors that accept lower standalone equity returns because they internalize management and incentive fees.

When asked what share of the primary market these captive funds represent, Joe Kupka noted: "I expect in 2026, the majority of that issuance, if it continues, will be from these captive funds, just given the compressed arbitrage."

CEO Jonathan Cohen acknowledged this is "a potential factor in terms of future likely performance for CLO equity tranche investments, but I think there are a great deal of other factors that are equally or perhaps even more important."

Why Cut the Dividend Now?

Analyst Erik Zwick (Lucid Capital Markets) asked whether the dividend cut was driven by secondary market opportunities rather than declining earnings power.

Cohen confirmed: "We are seeing what we consider to be generally strong opportunities in the secondary market... Given that we believe we are one of the world's largest market participants in the secondary market, we are trying to position ourselves to take advantage of those."

Joe Kupka elaborated on the opportunity: "In this environment, with the arbitrage at or near historic tights, you see that NAV compress or sometimes even flip. So the optionality, you really see that optionality in terms of capturing that NAV, whether that's through reset plays or just liquidation of the CLO."

Could There Be a Special Dividend?

Zwick noted that earnings power still appears to exceed the new distribution rate and asked about potential special dividends.

Cohen responded: "To the extent that we want or need to reflect the earnings level of the fund in the distributions, yes, it is certainly possible that we declare a special dividend or modify the existing rate of distribution to comport with those fundamentals."

Any such action would be evaluated based on Oxford Lane's fiscal year, which ends in March.

Reset and Refinancing Outlook for 2026

Joe Kupka was bullish on reset/refi activity: "This year should be a very active year in terms of resets and refis for us... We participated or led about 70 resets or refinancings [in 2025]."

Key catalysts: Starting in July 2026, a significant portion of the portfolio rolls off non-call periods with AAA spreads in the 130s-140s.

What to Watch Going Forward

- NAV stabilization — Can the retained capital and secondary market opportunities stem further NAV erosion?

- Reset/refi wave — July 2026 starts a period of active resets with AAA spreads in 130s-140s

- Captive fund dynamics — Will captive CLO funds continue to compress arbitrage for third-party investors?

- Coverage ratio — At the new distribution rate, Core NII should comfortably cover dividends

- Special dividend potential — If earnings exceed distributions, management indicated willingness to pay specials

Key Takeaways

- Dividend slashed 50% to $0.20/month as Board prioritizes NAV preservation

- NAV cratered 19% to $15.51 on $305M unrealized losses

- Core NII down 10% to $1.12/share, but now well-covered by lower distribution

- Stock down 10% after-hours to $12.80, near 52-week lows

- Yield compression continues across CLO equity portfolio

The dividend cut, while painful for income investors who bought OXLC for its high yield, may ultimately prove necessary to stabilize NAV and position the fund for recovery when CLO markets improve.

Sources: Oxford Lane Capital Q3 FY2026 Earnings Call Transcript , Investor Presentation , Press Release